Understanding Ohio’s auto accident insurance claim laws requires a clear understanding of fault-based insurance rules, the responsibilities of each party, and the steps an injured person must take to recover compensation.

Whether you’re filing a claim with your own policy or pursuing the other driver’s insurance company for medical bills, lost wages, or vehicle repairs, the legal process can quickly become complicated.

In the aftermath of a traffic accident, you’ll need to act carefully and promptly, especially if the insurance company denies your claim or attempts to undervalue your losses.

Below, we outline key laws and procedures that govern car accident lawsuits, bodily injury claims, and auto insurance disputes in Ohio.

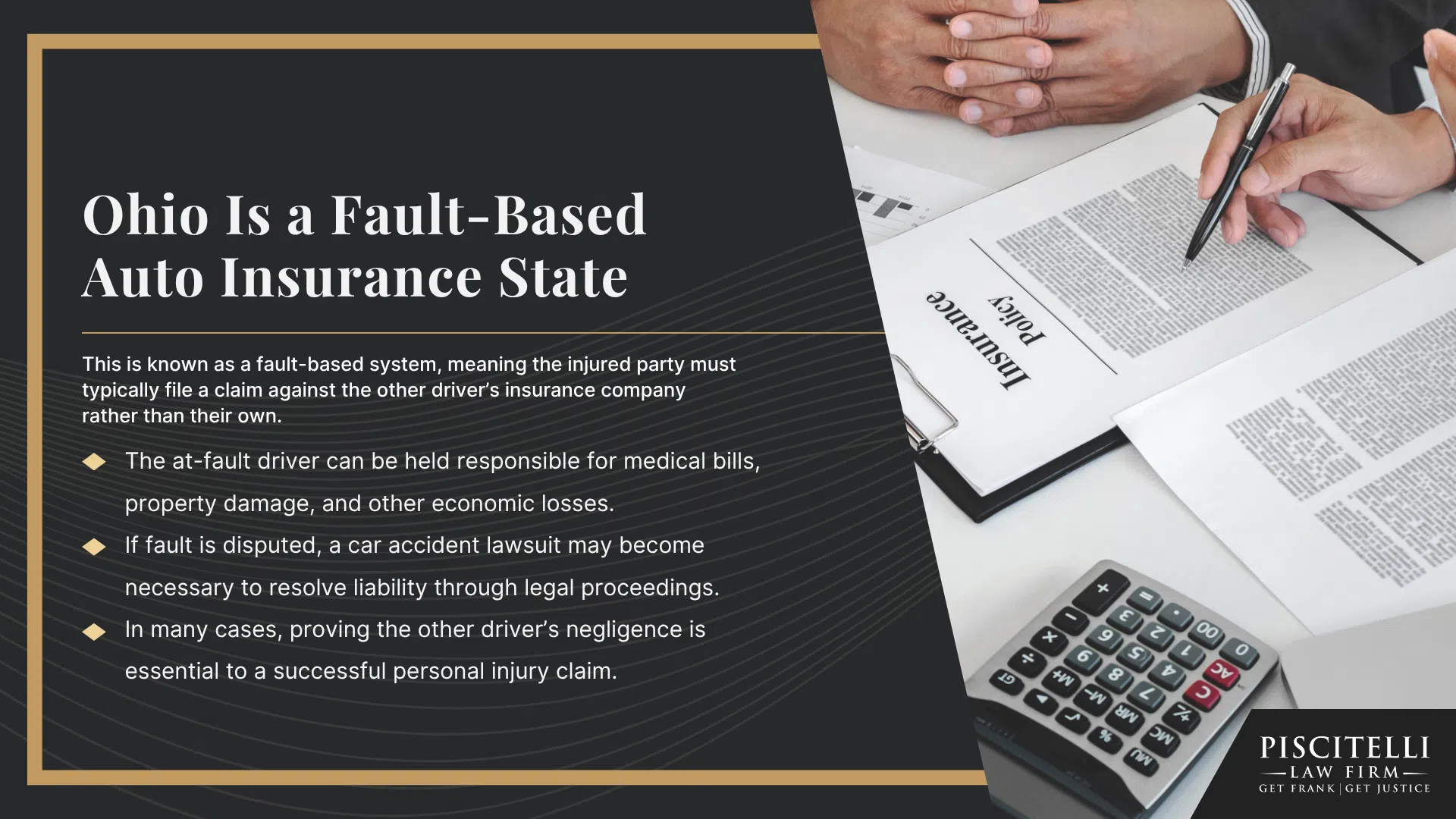

Ohio Is a Fault-Based Auto Insurance State

In Ohio, the at-fault driver is legally responsible for covering damages caused in a car accident.

This is known as a fault-based system, meaning the injured party must typically file a claim against the other driver’s insurance company rather than their own.

- The at-fault driver can be held responsible for medical bills, property damage, and other economic losses.

- If fault is disputed, a car accident lawsuit may become necessary to resolve liability through legal proceedings.

- In many cases, proving the other driver’s negligence is essential to a successful personal injury claim.

Ohio law does allow for comparative negligence, which means that if you are partially at fault, your compensation may be reduced based on your percentage of fault.

Minimum Insurance Requirements in Ohio

Under Ohio law, all drivers are required to carry a minimum level of bodily injury liability and property damage liability insurance.

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $25,000 for property damage

These minimums may not be enough to cover the full extent of damages in serious crashes, which is why many drivers opt for higher policy limits or uninsured/underinsured motorist coverage under their own policy.

Filing a Claim After a Traffic Accident

If an injury occurred in a traffic accident, the best course of action is to begin the legal process as soon as possible.

Most claims begin with the injured party submitting a demand to the other driver’s insurance company. The claim must include evidence of liability, medical documentation, and proof of losses.

You may be required to:

- Provide forms documenting the extent of your injuries and treatment

- Submit estimates from a repair shop for vehicle damage

- Prove lost income with employment records and tax returns

- Justify any expenses related to a rental vehicle or car loan

If the insurance company denies the claim or offers a lowball settlement, you may need to escalate to a formal car accident lawsuit to pursue a fair settlement.

Timelines and Legal Deadlines to Know

Ohio has a two-year statute of limitations for filing most personal injury lawsuits related to auto accidents.

This means you have two years from the date the injury occurred to file a lawsuit or settle your claim.

- Failure to file in time can forfeit your legal rights

- Even if you’re dealing with your own insurance company, delays can result in administrative denials

- Claims involving minors or wrongful death may have different deadlines, so legal guidance is critical

Bodily Injury Claims and Medical Bills

Bodily injury claims seek compensation for medical bills, lost wages, and non-economic losses like pain and suffering or emotional trauma.

These claims often rely on thorough documentation:

- Emergency room records, specialist referrals, and diagnostic imaging

- Proof of physical therapy or long-term care

- Medical opinions connecting the treatment directly to the accident

Insurance companies may try to downplay the severity of injuries or argue they stemmed from a pre-existing condition.

Having a personal injury attorney to oversee documentation can prevent costly mistakes.

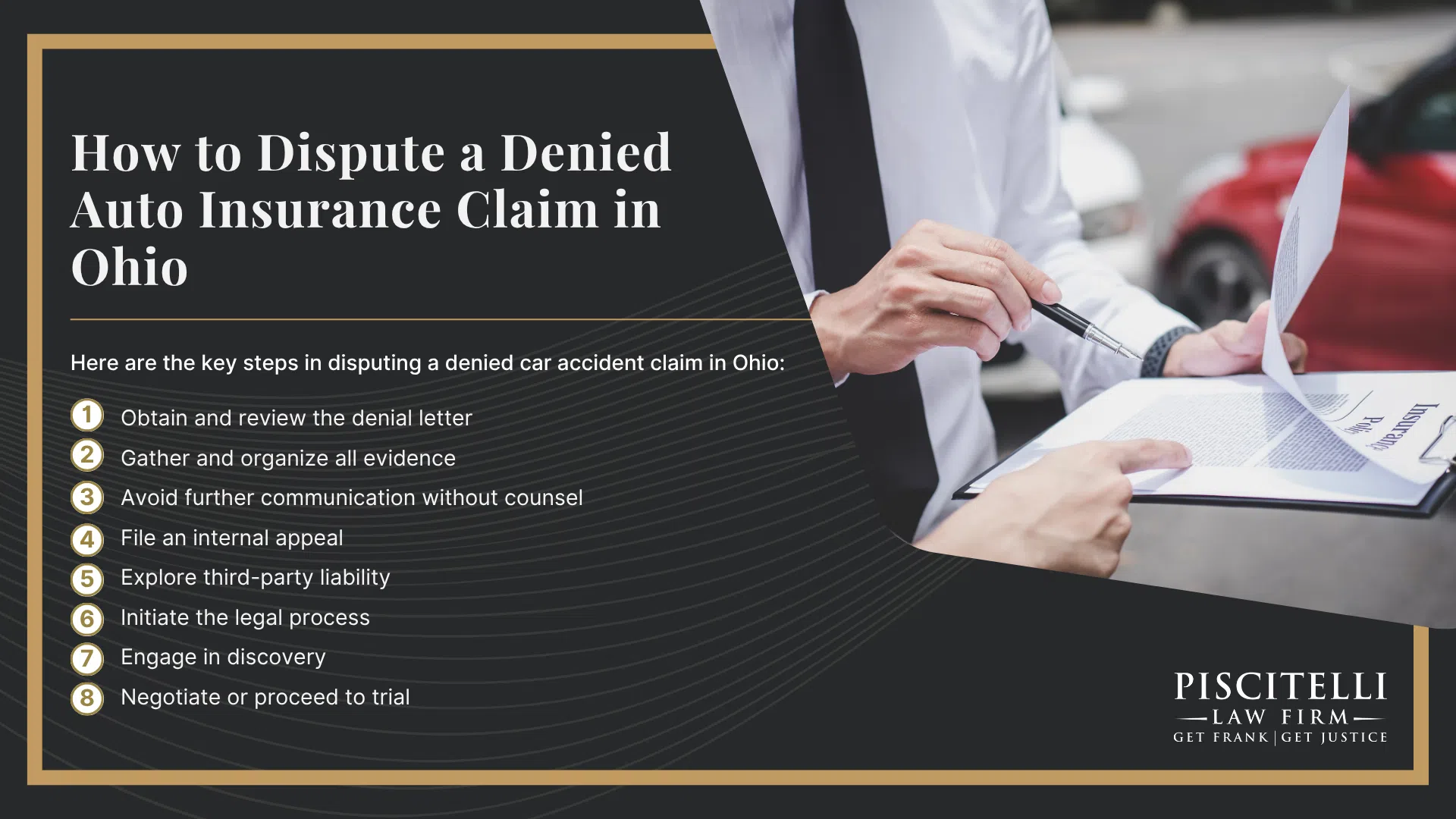

What Happens If the Insurance Company Denies Your Claim?

An insurance denial can happen for various reasons—disputed liability, missing documentation, delays in treatment, or violations of the insurance policy.

If your claim is denied:

- Request a detailed explanation in writing

- Review the policy language with your attorney

- File an appeal or file a lawsuit if informal resolution fails

You may still be able to recover compensation for all losses related to the accident, including medical expenses, lost income, and other damages.

Additional Damages That May Be Recovered

Depending on the facts of the case, compensation may vary depending on the severity of the injuries, level of property damage, and impact on your life.

Some victims may also be eligible to pursue punitive damages in cases of gross negligence.

Common recoverable losses include:

- Medical bills (past and future)

- Lost wages

- Pain and suffering

- Loss of earning capacity

- Damage to your vehicle

- Rental car expenses

- Interest on a car loan while the vehicle is unusable

- Emotional distress

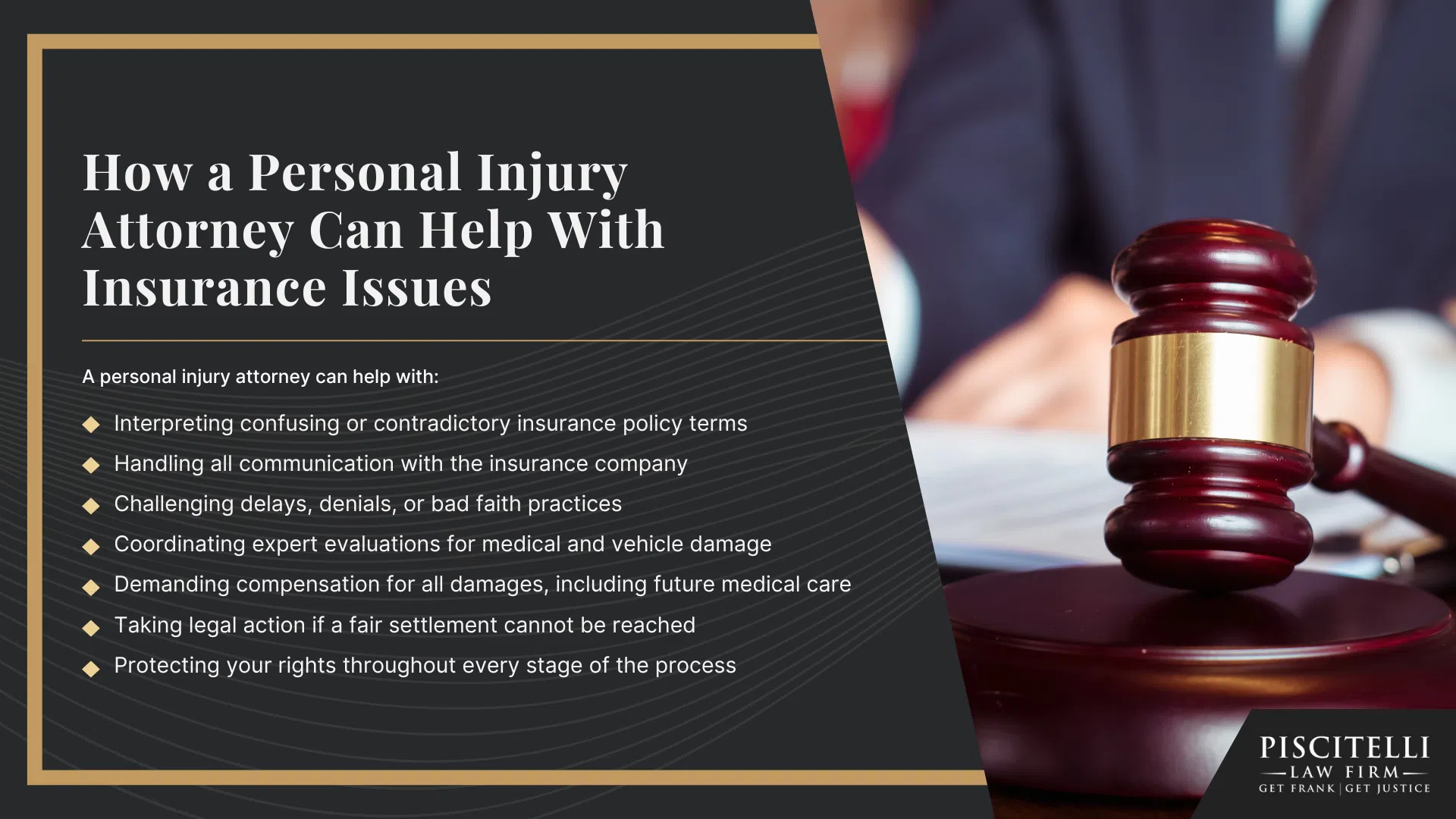

The Role of Legal Representation in the Claim Process

From gathering evidence to dealing with car insurance adjusters, an experienced attorney can help avoid errors that derail your claim.

Legal counsel is especially important when:

- The insurance company is acting in bad faith

- Multiple parties are held responsible

- You need help calculating your full losses related to the crash

- There is a dispute over who caused the accident

A personal injury attorney from the Piscitelli Law Firm can step in to negotiate on your behalf, manage all legal proceedings, and fight for the financial compensation you deserve.