Some car accident claims can be handled without legal counsel when the facts are clear and the losses are limited.

These situations typically involve property damage rather than physical harm and do not raise questions about fault or coverage.

Insurance companies are more likely to process claims efficiently when car repairs are straightforward and documentation is complete.

Filing on your own may also make sense when the other driver accepts responsibility and their insurance policy clearly applies.

Claims without legal complications tend to move faster and involve fewer disputes over valuation.

Many drivers choose to pursue these claims independently to resolve damage quickly and avoid unnecessary delays.

That approach often works when communication with the insurer remains consistent and transparent.

Still, even simple claims require attention to detail and an understanding of how insurers review information.

You may be able to handle a car accident claim on your own when:

- The claim involves only property damage, with no reported injuries

- Car repairs are limited, documented, and supported by repair estimates

- Fault is clear and not subject to disputed fault arguments

- The other driver’s insurance policy is active and provides sufficient coverage

- The insurer does not challenge liability, damages, or claim timing

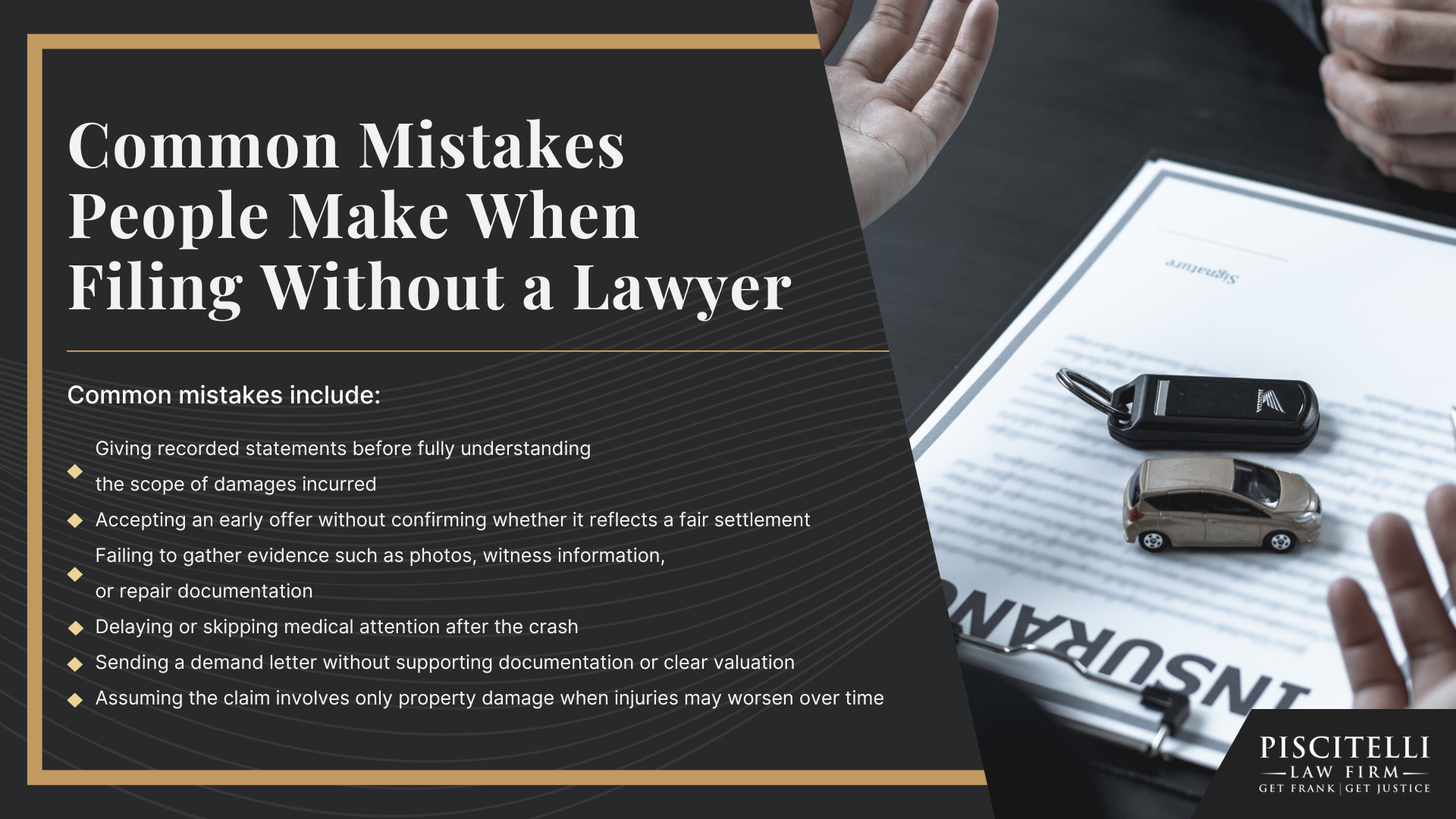

Even in these situations, insurers evaluate claims based on internal guidelines rather than fairness alone.

A missed document or unclear statement can affect how a claim is valued or whether payment is delayed.

Drivers handling claims without legal help should understand what their insurance policy requires and what information the insurer may request.

When questions arise about coverage limits, responsibility, or settlement value, reviewing your legal options becomes important.

If a claim begins to stall or shift toward disputed fault, seeking legal counsel may provide clarity before issues escalate.