The Ohio wrongful death statute was created to provide a clear legal path for families who lose a loved one due to another party’s negligent or intentional conduct.

When a decedent’s death occurs because of a wrongful act, neglect, or default, the law allows certain surviving relatives to pursue a wrongful death suit for justice and accountability.

These claims are filed in civil court and are distinct from any criminal prosecution that might also arise from the same event.

In most cases, the lawsuit is brought by a personal representative of the deceased person’s estate, but the recovery is held for the exclusive benefit of the spouse, children, parents, or other dependents.

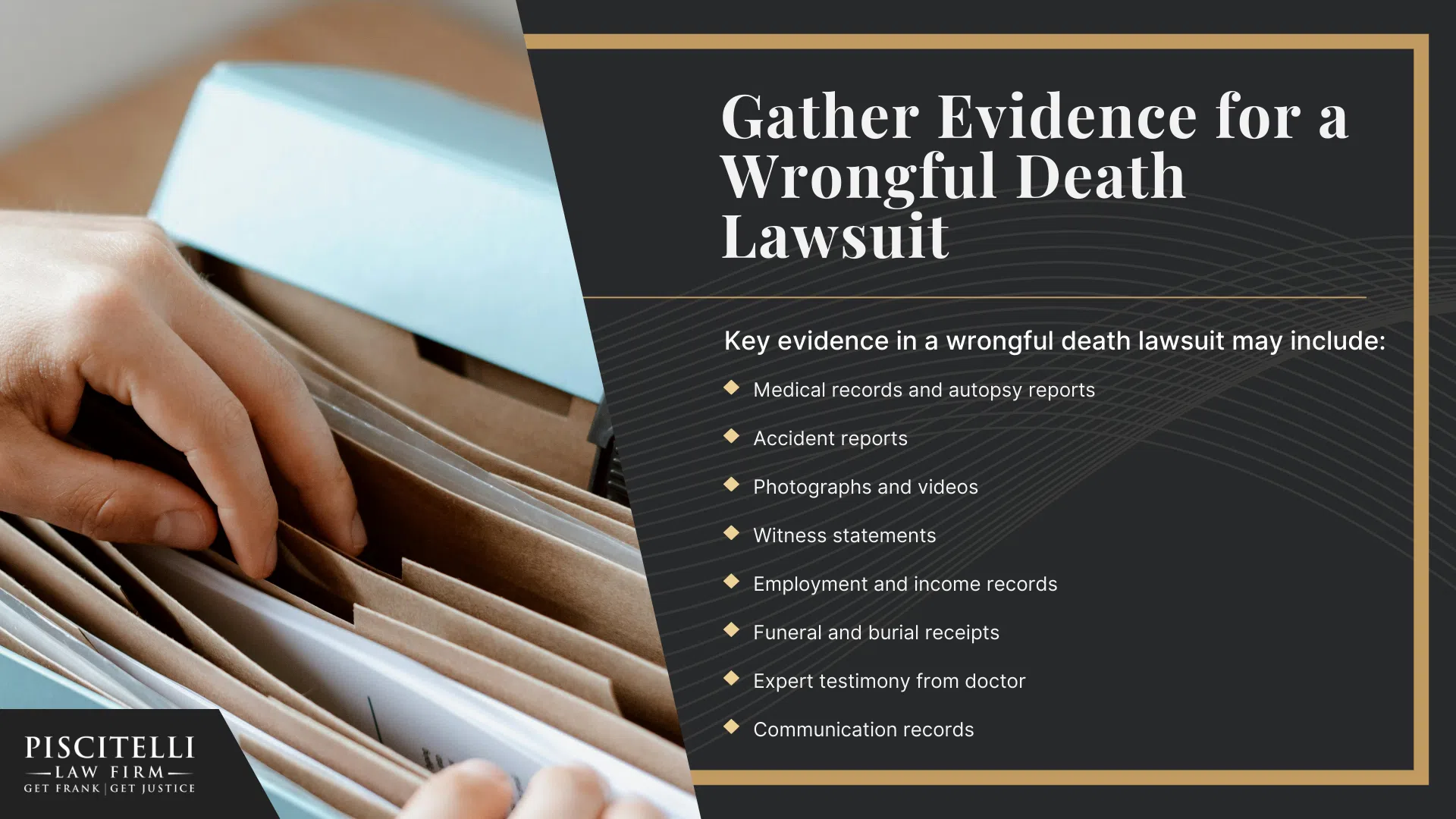

To succeed, the plaintiff must prove that the death directly resulted from the defendant’s misconduct and that the surviving family suffered measurable harm as a result.

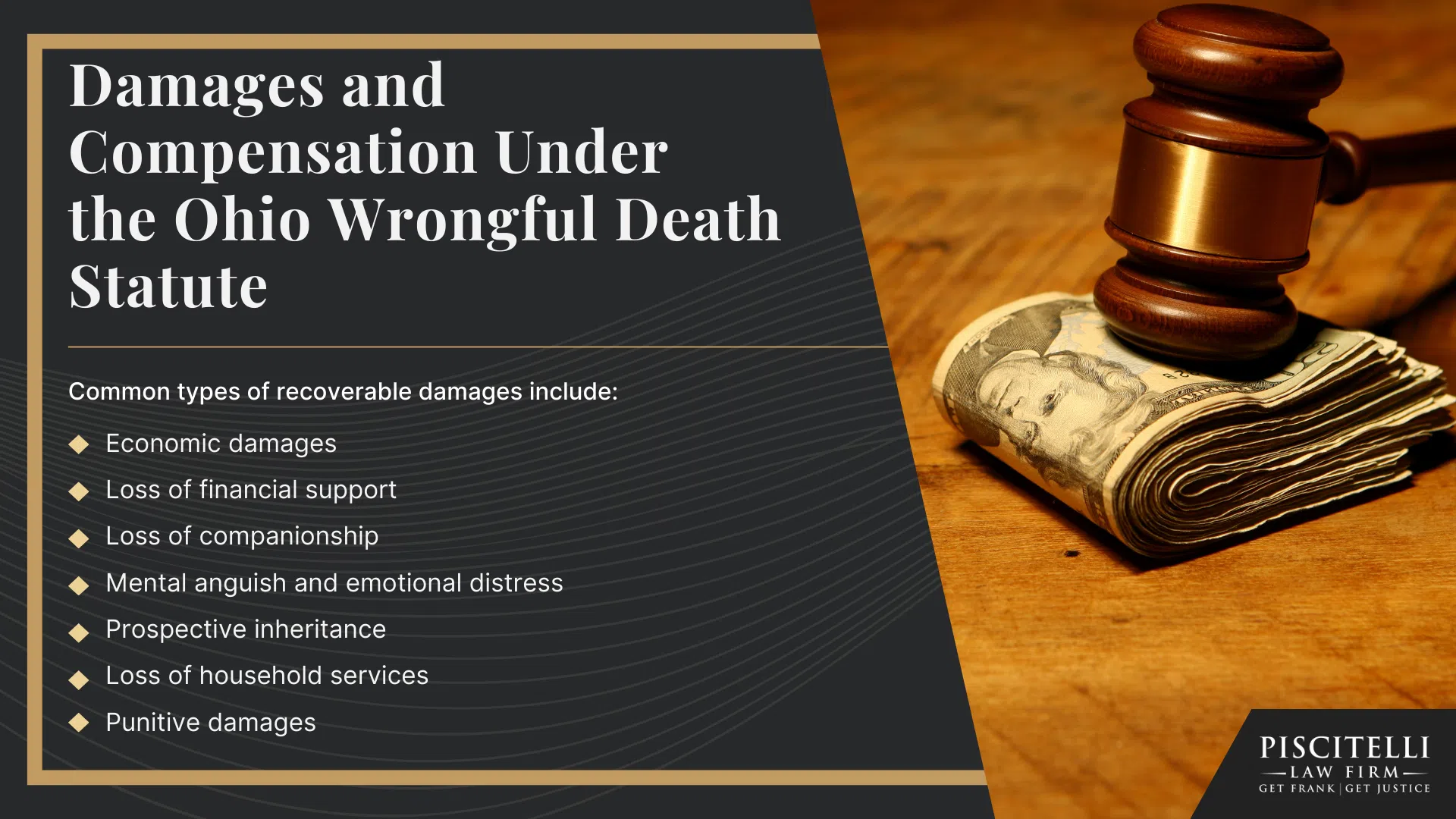

This harm can include both emotional suffering and financial losses, such as the loss of income or support the decedent would have provided.

The Ohio law is designed to help families recover damages that reflect both the economic and non-economic impact of losing a loved one.

Through this form of legal action, families can hold negligent individuals, corporations, or entities accountable and prevent similar tragedies from happening to others.

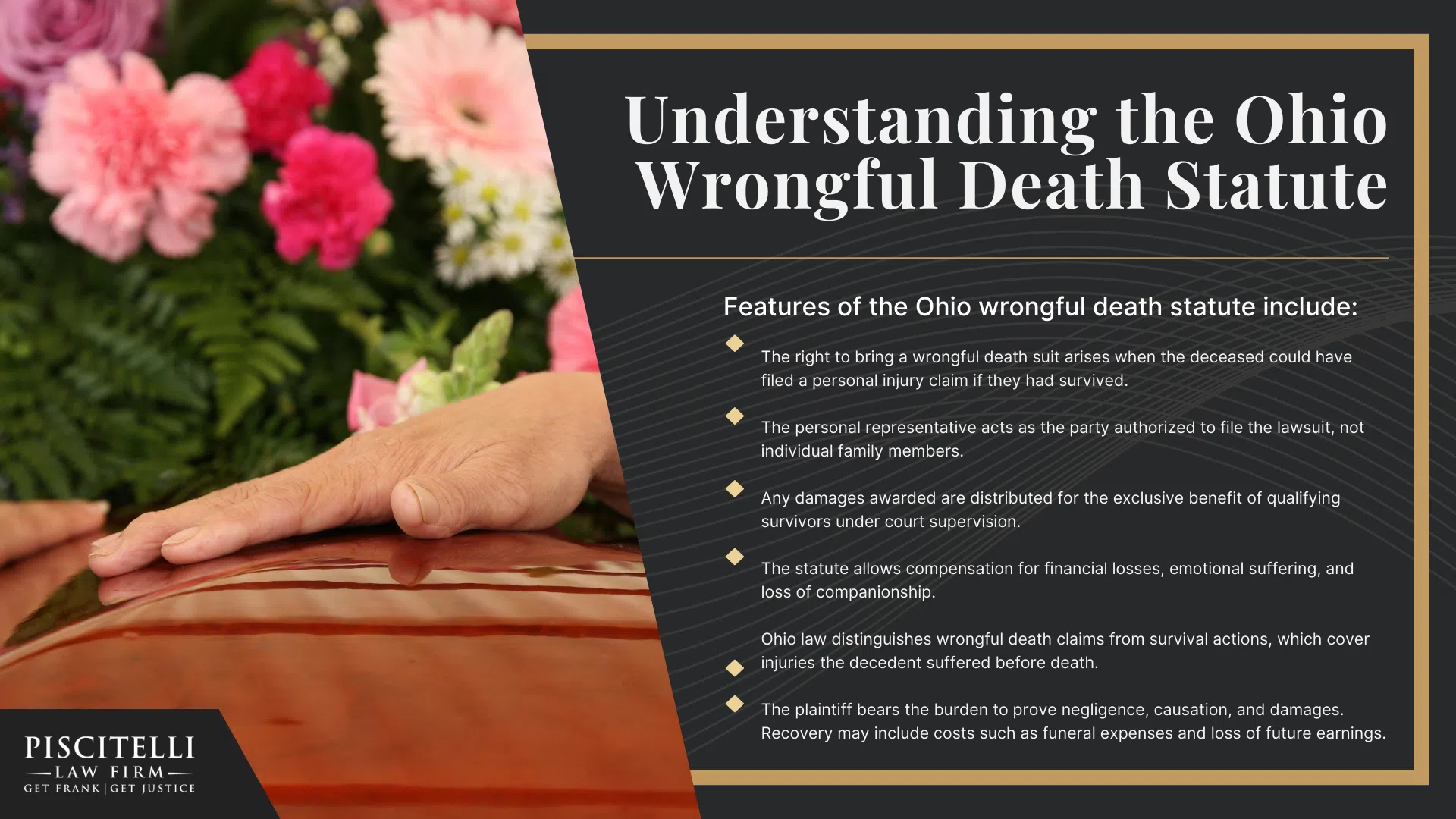

Features of the Ohio wrongful death statute include:

- The right to bring a wrongful death suit arises when the deceased could have filed a personal injury claim if they had survived.

- The personal representative acts as the party authorized to file the lawsuit, not individual family members.

- Any damages awarded are distributed for the exclusive benefit of qualifying survivors under court supervision.

- The statute allows compensation for financial losses, emotional suffering, and loss of companionship.

- Ohio law distinguishes wrongful death claims from survival actions, which cover injuries the decedent suffered before death.

- The plaintiff bears the burden to prove negligence, causation, and damages.

- Recovery may include costs such as funeral expenses and loss of future earnings.

After a verdict or settlement, the probate court oversees the fair distribution of compensation among the eligible beneficiaries.

The court ensures that each dependent or family member receives a proportionate share based on the degree of loss they suffered.

This oversight helps prevent disputes and keeps the process transparent for everyone involved.

Families often find this phase emotional, as it represents both justice served and a recognition of the financial losses they now face.

An experienced attorney can help guide the plaintiff through each step of the process, ensuring that no detail is overlooked and that all deadlines are met.

In the end, the wrongful death statute stands as one of Ohio’s most important protections for families seeking accountability and closure after a preventable tragedy.

Who Can File a Wrongful Death Lawsuit Under Ohio Law?

Under Ohio law, a wrongful death lawsuit must be filed by the personal representative of the deceased person’s estate, not by individual family members.

This representative acts on behalf of the close family members who are legally entitled to benefit from the case.

The probate court ultimately determines how any award of financial compensation is divided among those who suffered losses due to the death.

Ohio’s wrongful death statute prioritizes the spouse, children, and parents, but other family members may also qualify if they can prove dependency or loss of inheritance rights.

The goal of this structure is to ensure fair distribution based on emotional and financial impact, rather than who filed the case.

Those who may benefit from a wrongful death lawsuit include:

- The surviving spouse of the deceased.

- Children, whether biological or legally adopted.

- Parents of the deceased, if no spouse or children survive.

- Other family members (such as siblings or grandparents) who can prove financial dependency or loss of support.

Ohio’s Statute of Limitations for Wrongful Death Claims

In Ohio, families generally have two years from the date of their loved one’s death to file a wrongful death lawsuit, known as the statute of limitations.

This time period is established under Ohio Revised Code §2125.02 and serves as a strict deadline for initiating legal action.

Missing this window can permanently bar a family from recovering compensation, regardless of how strong the evidence may be.

Certain circumstances, such as deaths involving defective products or medical malpractice, may involve additional statutes of repose or discovery rules that affect when the deadline begins.

Because these exceptions are narrowly applied, it’s crucial to consult experienced legal counsel early in the process.

An attorney can review the facts, determine when the clock started, and ensure all necessary filings are made before the limitation expires.

Acting promptly gives families the best chance to preserve evidence and protect their right to justice within the statutory two-year period.

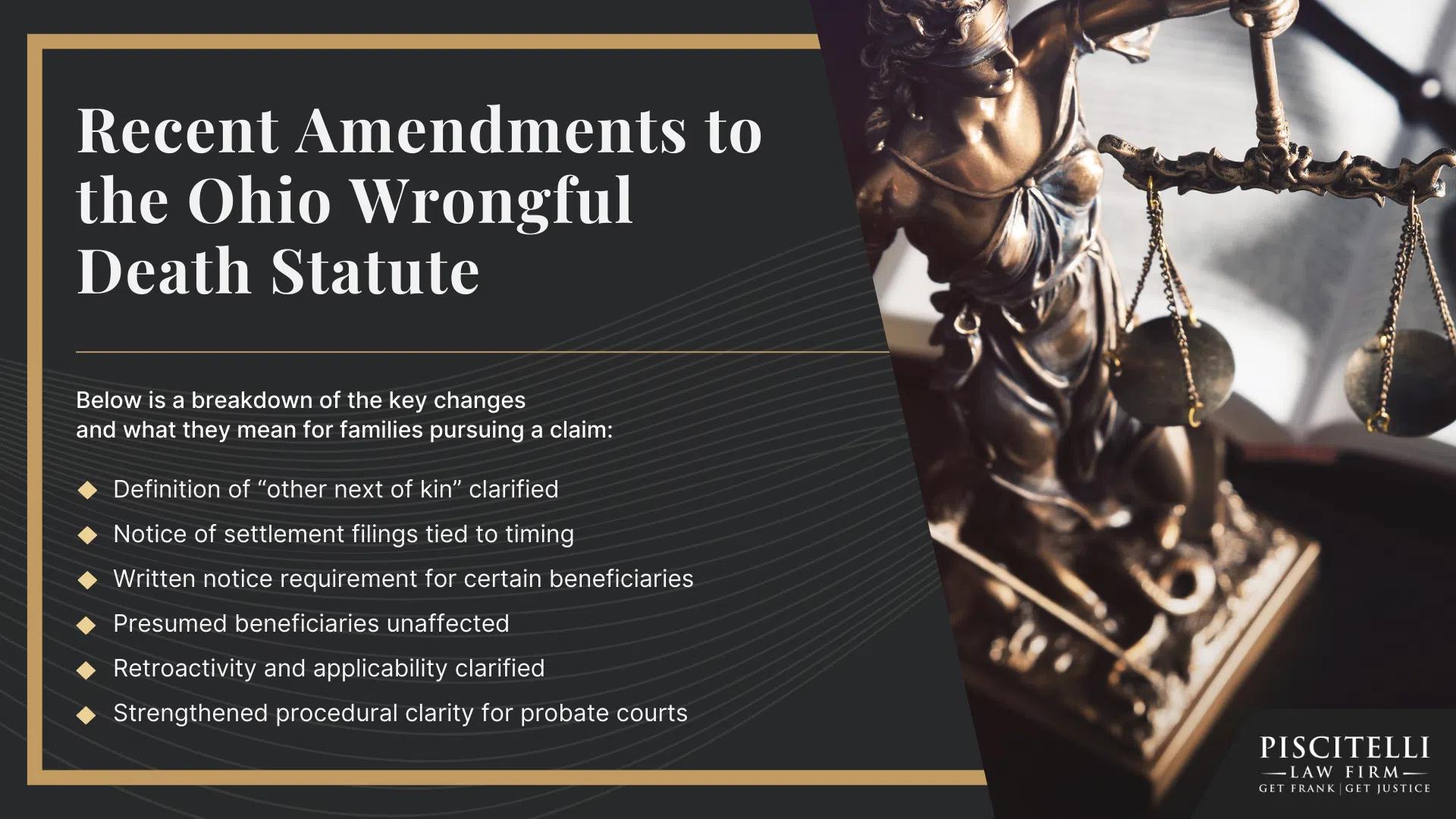

Recent Amendments to the Ohio Wrongful Death Statute

Ohio’s wrongful death law underwent significant updates in 2023 that clarify who must be notified in a settlement and how claims can be filed and distributed.

These modifications enhance transparency in the process and address longstanding inconsistencies across probate courts.

Below is a breakdown of the key changes and what they mean for families pursuing a claim:

- Definition of “other next of kin” clarified: The statute now explicitly defines “other next of kin” as the nearest surviving relatives after accounting for a spouse, children, or parents.

- Notice of settlement filings tied to timing: If an application to approve settlement of wrongful death and survival claims is filed on or before two years from the decedent’s death, all “other next of kin” must be notified. If filed after two years, no “other next of kin” are entitled to notice unless they file a written notice of claim within two years.

- Written notice requirement for certain beneficiaries: To retain status as an interested person, “other next of kin” who are not automatically entitled to notice must file a written claim with the probate court by the two-year deadline including their name, address, phone number, and relation to the decedent.

- Presumed beneficiaries unaffected: The amendment preserves the presumption that a surviving spouse, children, or parents of the decedent have suffered damages, and continues to treat them as interested persons entitled to notice.

- Retroactivity and applicability clarified: The bill states that these changes apply to decedents who died on or after the effective date, aligning older civil actions accordingly.

- Strengthened procedural clarity for probate courts: The amendments require explicit listing of damages and allow evidence of annuity costs or remarriage of the spouse when calculating future damages under section 2125.02(C)(2)(b).

These edits are designed to make wrongful death proceedings more efficient, reduce confusion about beneficiaries, and ensure that those legitimately entitled to compensation are given proper notice and opportunity to participate.

If your loved one’s death occurred near or after April 4, 2023 (when these amendments were implemented), it’s important to discuss with counsel how these changes may affect your case and the time period for distributing recovery.

Understanding these amendments helps families act quickly and strategically to protect their interests.